The Insolvency Service published the new 2025 IVA Protocol to help protect people in debt. The revised protocol comes into effect on 1 July 2025, which is not far away. Across England & Wales, a total of 64,050 IVAs were registered in 2024. In 2024, the Insolvency Practitioners Association (IPA) Volume Provider (VPR) Scheme regulated 71% of the IVA market and 73% of the PTD market.

The new protocol includes creditor and IVA provider obligations.

Footnote on release

“Anyone in problem debt should seek free, regulated debt advice and ask about the breathing space service while they explore possible solutions to suit their circumstances.”

The role of breathing space needs to be examined more closely, especially around consistency of usage and the actual value of standard breathing spaces. They do seem to be a potential powder keg for vexatious complaints, where consumers don’t follow their obligations. Creditors following their obligations can be a real ‘mixed bag’.

Some of the main changes to the protocol include:

- Clearer guidance for when an IVA is not suitable (e.g. if a consumer qualifies for a DRO)

- The consumer’s family home will no longer form part of their IVA if the providers and creditors follow the protocol

- Where an IVA is terminated, a requirement that the supervisor should signpost the consumer to free, regulated debt advice

"Without labouring the point over and over again, regulated debt advice providers don’t charge for debt advice or breathing space. Many IVA providers have a regulated debt advice entity within a ‘group’ structure (e.g. Bennett Jones (UK) , Freeman Jones , MoneyPlus , PayPlan , StepChange Debt Charity , The Insolvency Group). Some of these are funded by Money and Pensions Service as a DRO hub (e.g. Money Wellness) or highlighted by MoneyHelper as national debt advice providers."

"We continue to have mixed messages from the FCA, The Insolvency Service and MaPS, where MaPS is the most straightforward. This became confusing with PS24/2 (Borrowers in Financial Difficulty) and the CONC 7 changes. It will get more confusing with the CCA and BNPL changes."

The new protocol is the result of a collaboration between the Insolvency Service, regulators, the trade association R3 Association of Business Recovery Professionals, creditors, providers and charities following 2024 research which found poor practice among some IVA providers.

Claire Hardgrave of The Insolvency Service said:

“It is vital that people with debt problems are always given quality advice. At the same time, Insolvency Practitioners need access to clear guidance in order to provide the best service possible. Since the publication of our report, we have been working with regulators and have met with Insolvency Practitioners to discuss our plans.

“This protocol provides much-needed safeguards and transparency for all concerned, ensuring there are fewer grey areas for the practice, and that people in debt are supported from the very start.”

In 2024, the Insolvency Service published research into the provision of IVAs, looking at 310 which had been both registered and terminated between 2021 and 2023, finding that 60% showed evidence of poor practice in the early stages.

The messages to the sector are fairly clear, with the IPA adding their voice to this.

IPA 2024 Volume Provider Report

The 2024 report highlights the leading IVA providers in the sector. The monthly data from The Insolvency Service has highlighted the fluctuations in the market. CDS routinely reports on this data.

IVAs made up 57% of personal debt solutions, while Debt Relief Orders (DROs) accounted for 37%.

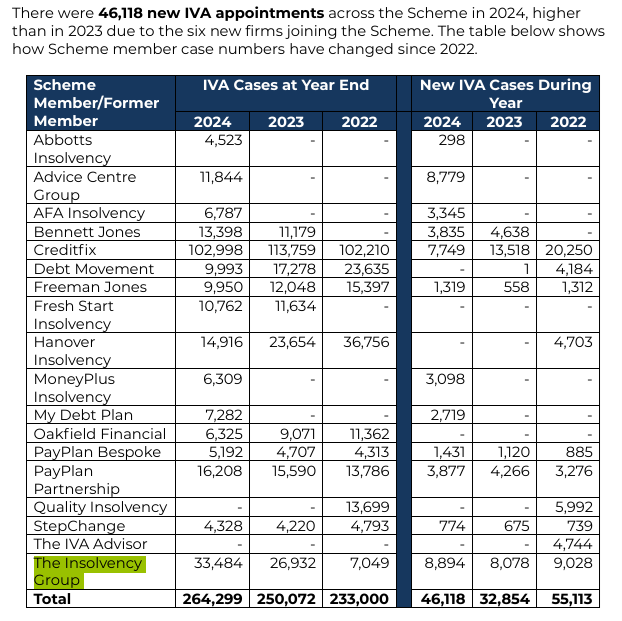

19 firms are members of the Scheme, representing 71% of the IVA and 73% of the PTD market. At 31 December 2024, the total number of open (new and existing) IVA cases was 373,0001. Of these, 264,298 were Scheme member cases.

The implementation of revised SIP 3.1 for IVAs and SIP 3.3 for PTDs has placed greater responsibility on IPs to ensure debtors receive tailored, high-quality advice.

Public complaints were low, with only 0.02% of IVAs and less than 0.01% of PTDs raising concerns.

Early failures remain an issue, with 5.7% of IVAs failing in their first year. This is typically much lower than early DMP failure rates. Common areas of concern included poor-quality advice, mis-selling, advertising issues, and excessive costs.

A total of 22,005 IVAs failed in 2024 (8.33% of Scheme member cases), mainly due to arrears or changes in financial circumstances. 4,115 failed in the first year, with the majority failing in year two.

As at 31 December 2024, 23% of IVAs registered in 2021 and 18% registered in 2022 had terminated. The equivalent number as at 31 December 2022 was 20% for IVAs registered in 2019 and 14% for those registered in 2020.

Among Scheme members, 33,036 IVAs were completed during 2024, with a total debt write off for debtors of £386,179,045, and with £214,176,853 distributed to creditors.

The IPA reviewed a total of 1,030 cases during 2024 over 86 visits and reviews.

Concerns remained regarding the accuracy of debt advice provided to each consumer so that there are clear choices and consistent outcomes, as well as the advertising practices used to promote IVAs and other debt solutions. Consumers must be supported to make informed decisions, and advertising must be responsible, accurate and underpinned by creditor support and understanding. This will be the focus of the IPA’s inspection and other monitoring in 2025.

The IPA urges regulators to work together for greater data-sharing and consistent debtor protections across insolvency solutions.

Creditor event on 10 July 2025 in Grantham

Consumer Duty Services (CDS) is running a creditor event on 10 July 2025 in Grantham to discuss the creditor obligations along with the impact of the IVA sustainability score since used by PayPlan from Q4 2024.

Please drop Peter Wordsworth or me a note if you are a creditor or part of their supply chain.

CDS ran creditor events in March and May 2024. Leading banks and debt buyers are presenting. It starts at 10am and finishes after a buffet lunch.

Claire Hardgrave, the former Head of Insolvency Practitioner Regulation for the Insolvency Service, spoke at the CDS IP event in October 2024 and at the IPA conference in November 2024.

The new protocol includes an easy-to-read ‘key facts’ document which will be given to people in debt before they sign up to an IVA. The protocol also gives greater clarity to Insolvency Practitioners about their responsibilities when giving advice about IVAs.

This should be applicable to all regulated providers of debt advice.