The Insolvency Service has published the personal insolvency statistics for England & Wales and Northern Ireland on 20 May 2025.

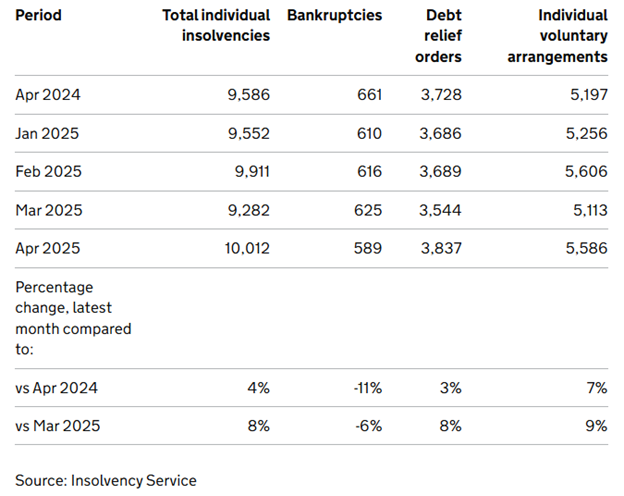

In April 2025, 10,012 individuals entered insolvency in England & Wales, which was 8% higher than in March 2025 and 4% higher than in April 2024.

The individual insolvencies consisted of:

- 589 bankruptcies

- 3,837 DROs - similar to the record high levels seen over the past 12 months

- 5,586 IVAs - similar to the average monthly number seen in 2024

Summary of changes since April 2024

Bankruptcy numbers remained at about half of pre-2020 levels and were also 11% lower than in April 2024. 76.5% were debtor applications. There was 1 Income Payment Order (IPO) and 52 Income Payment Arrangement (IPA), suggesting again that the majority have limited surplus income.

1,874 DRO were registered by Money Wellness and 1,165 by Citizens Advice.

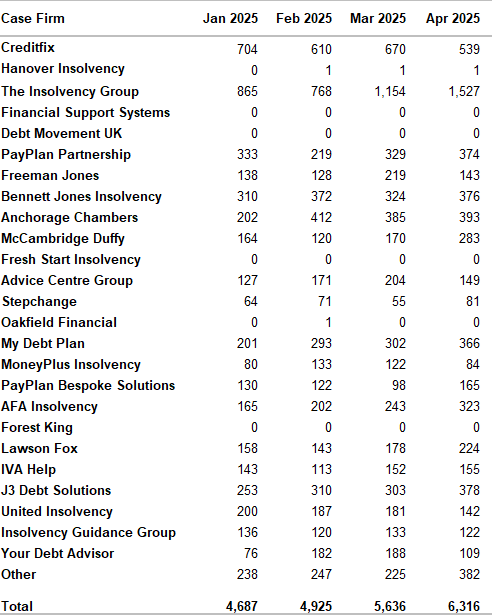

IVAs

The Insolvency Group topped the IVA table in the month with 1,527. Creditfix and PayPlan both came in at 539. StepChange registered 81. The 5,586 figure above is different from the total below 6,316.

Self-employed

This data lags 2 months behind the data above.

In February 2025, there were 95 bankruptcies where the individual was self-employed. This is 17% lower than in January 2025 and 21% lower than in February 2024. There were 380 bankruptcies among other individuals in February 2025, which is 3% higher than in January 2025 but 18% lower than in February 2024.

Northern Ireland

In April 2025, there were 123 individual insolvencies in Northern Ireland. This was 10% higher than in April 2024. There were 95 IVAs, 16 bankruptcies and 12 DROs.

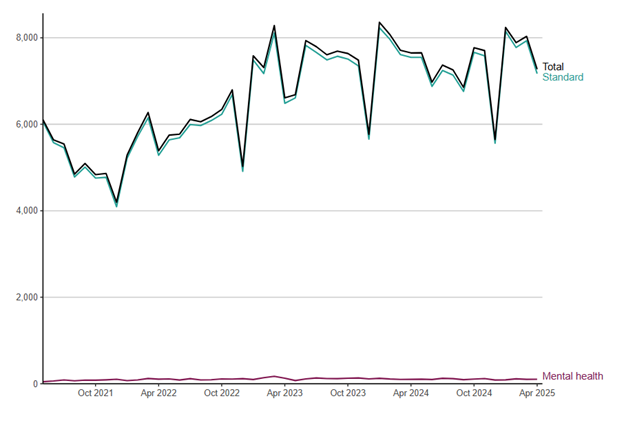

Breathing Space

There were 7,273 Breathing Space registrations in April 2025. This is 5% lower than in April 2024. Only 103 were Mental Health Breathing Spaces.

StepChange Debt Charity registered 4,070 cases. The next closest was Citizens Advice with 960 and then Money Wellness with 600. Several for-profit firms routinely feature in the table.

Breathing spaces since inception

Consumer Duty Services continues to monitor new IVAs and their sustainability over the first 3 years. We will be running further creditor and IVA provider events through 2025.

The next creditor event is on 10 July 2025 in Grantham.