The Insolvency Service has published their Annual Plan for 2025/26. Peter Wordsworth, director of Consumer Duty Services, reflects on the current state of the IVA market, and what each of the constituent parts can do to make it better.

Their current strategy aims to improve the customer experience, modernise their IT and ensure the insolvency and enforcement regimes deliver for stakeholders and the economy. They are continuing partnerships with HMRC and Companies House to tackle harm and identify and disrupt illegal activity such as money laundering. Some of this also relates to Economic Crime reform which is applicable to many firms and directors in 2025.

A way forward in the interim

We live in an imperfect world and the IVA market is far from perfect. No one person, government, company or even AI can fix it on their own but together, if we all do what we can, we can help to make it better. That is what motivates us to recycle, support charities and just do our bit.

So, we have a choice - we can do nothing but moan and blame others, in which case nothing will change, or, all the constituent parts can do what they can, and together we can make it better.

It may sound naive and not for everyone or even a majority will probably do anything but almost every change starts with a few single minded individuals who have decided that change is required.

So what can each constituent part do? Here are some suggestions – not an exhaustive list but a good a place as any to start…

The Insolvency Service/Regulators

The challenges the IVA market faces are well known and documented. To be fair, the Insolvency Service have already outlined the changes to the regulatory framework that they wish to make to help address these. That was done on the 12th September 2023 when the Government published the outcome of the consultation on The future of Insolvency regulation. In summary that was;

- To give the Insolvency Service the power to appoint a single regulator, so they had that option, if they could not make the current multiple RPB structure work.

- Regulation of IP firms as well as IPs (currently it is only the IPs who are regulated).

- The creation of a public register of IPs and IP firms that would enable the public to check the details of the firm or IP they were considering using. The register would also contain details of any regulatory misdemeanours.

These are all sensible changes. The problem is they each require secondary if not primary legislation and that means they are subject to the availability of parliamentary time. So in reality that means these changes could still be several years away.

In the longer term the Insolvency Service has also recognised that the IVA was never designed as a high volume low value consumer insolvency solution. So they are going to consult in 2026/27 on whether this should be replaced by something more suitable, with IVA remaining available for more complex individual cases.

They may have a good point, but, if regulatory change may still be years away, then such a fundamental change to the whole basis of personal insolvency in England & Wales is likely to be at least 7-10 years away.

So whilst the Insolvency Service is committed in its annual plan for 2025/26 to continuing to push these longer term objectives forward, what can be done in meantime, by the various regulators to improve things, within the current imperfect regulatory framework?

Here are 3 suggestions of things they can do which would make a significant and positive impact;

- Follow up on the findings of the research the Insolvency Service commissioned into poor take on practices for IVAs.

- Be more visible, have a higher profile in relation to the work they are doing on IVAs.

- Continue to work closely with the FCA and the ICO.

There is already some encouraging signs relating to all of these.

Part I of the Strategic Assessment describes the key threats they see to the integrity of the UK’s insolvency framework. One of the key concerns relates to poor practice in the IVA market. I suspect more to follow on this from the presentation by Claire Hardgrave at the Insolvency Practitioners Association (IPA) event in November 2024 last year and their recent Insolvency Service update for the 2025 IVA Protocol event that I presented at in Grantham on 10 July 2025.

In their annual report the Insolvency Service has identified one of its key strategic assessments for 2025/26 to deepen their understanding of “poor practice in the IVA sector”. This follows on from the findings of its research into concerns about take on practices for IVAs published on the 17th October 2024.

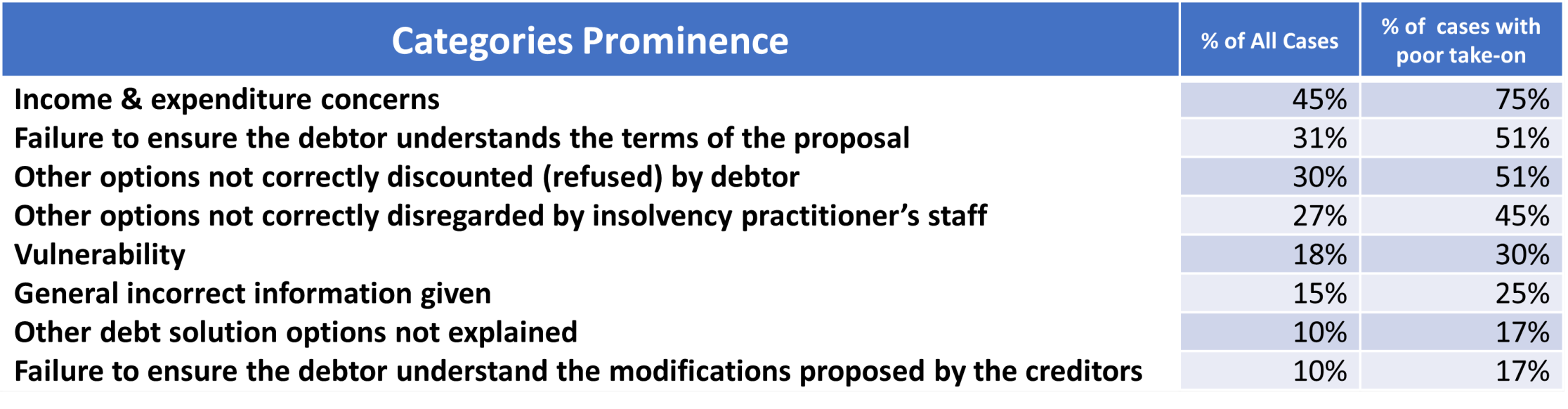

Those findings raised serious concerns about take on practices – particularly around the accuracy of income & expenditure assessments, ensuring consumers understood the terms of their IVA and the failure to properly consider other debt solutions.

The Insolvency Service report on early IVA failures from October 2024

The Insolvency Service report on early IVA failures from October 2024

It is imperative that the Insolvency Service and the RPBs continue to focus on addressing these significant areas of concern.

The Insolvency Practitioners Association (IPA) wrote to Justin Madders MP Minister for Employment Rights, Competition and Markets on 23 June 2025 around opportunities to make major improvements to insolvency regulation.

In terms of visibility/profile – one of the current misconceptions is that because there is very little visibility of current regulatory action, there is very little regulatory action. It is important for confidence in the market that the presence and effectiveness of regulator is both seen and felt.

The Insolvency Service has recently been joining the IPA on some audits/visits to IP firms. This is positive and to be welcomed, but again more visibility of this would be helpful.

Finally, the work the Insolvency Service has done with the FCA has almost been behind closed door – yet we know that the creditor obligations in the new IVA protocol were approved by the FCA and the FCA has confirmed that Creditors must consider consumer outcomes when voting on an IVA proposal.

It would be very powerful if the Insolvency Service and the FCA could be more public about their co-operation and how they are working together to deliver better outcomes for consumers in relation to IVAs.

Creditors

As discussed at one of our recent creditor events on 10 July 2025, creditors are arguably one of the most effective “regulators” in the IVA market. That is because they have the power, through their votes to approve or decline IVA proposals.

The difficulty is that, for understandable reasons, they have been reluctant to use that power. The last time we saw this power used was to force the introduction of the IVA protocol and the introduction of disbursement inclusive fees - which was in response to widespread abuse of disbursements in IVAs.

So creditors do have the power to fundamentally change the way IVAs work for the better.

So what can Creditors do to help improve things?

In a nutshell this is all about how they vote.

Many of the larger creditors use Voting agents. The FCA has made clear that Creditors cannot simply delegate their responsibility under the Consumer Duty when considering consumer outcomes, which they must do when voting on an IVA proposal.

The voting practices of most creditors have however not changed since the introduction of the Consumer Duty.

Early failures in IVAs are very poor outcomes for consumers because the vast majority of what they have paid will have been allocated to the IP firm not reducing their debts. Yet despite this we have seen no visible attempt by creditors to reduce or prevent these poor outcomes. Broad voting policies with little consideration of the individual still unfortunately prevail.

Perhaps it is time for creditors to consider a fresh approach to evaluating proposals which overlays available data and technology to identify those proposals at greatest risk of failure and conversely those proposals which have a very high probability of delivering a good consumer outcome i.e. completing their IVA.

Creditors could consider introducing a sustainability score into their evaluation process. Creditors could consider whether the income and expenditure had been independently validated in any way. Creditors could also include the track record of that individual IP firm.

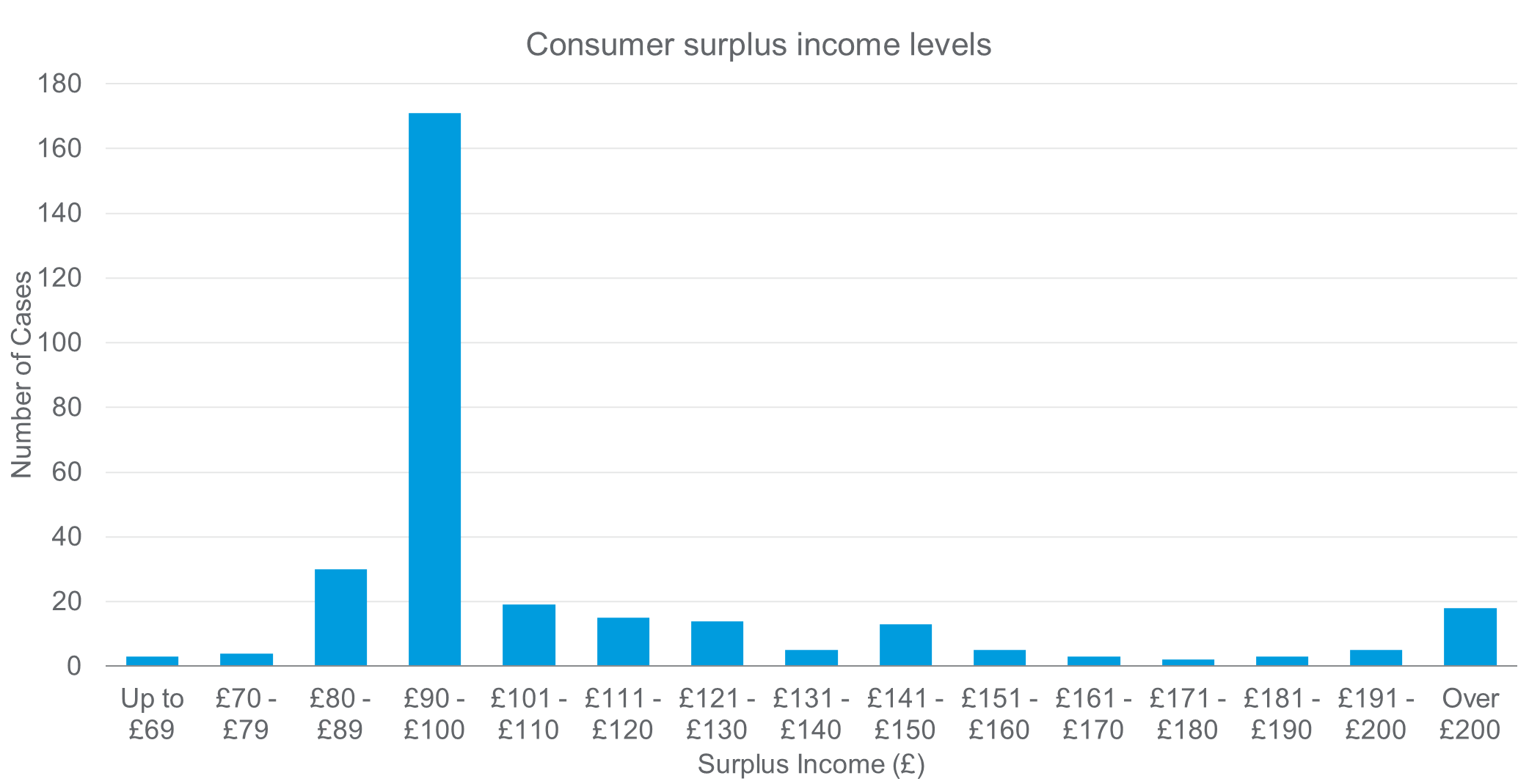

Perhaps an easy starting point is to for creditors and indeed the regulators for that matter, to focus on the validity of any IVA proposal with a surplus income level between £90-£100. The graph below was taken from the Insolvency Service report into poor onboarding practices published on 17th October 2024. This would indicate an unlikely concertation of surplus budgets in this bracket.

Polarity around the disposable income of failed IVAs

Creditors now have the opportunity to update their voting practices to both bring these in line with the FCA expectations and make better voting decisions. Why should they do this? Not just because the FCA may ask them one day why they did not, but because it is in their customer’s best interest and in the interests of their shareholders as early failures are bad news for everyone including the Creditors finances.

IP Firms

What can IP firms do to improve the situation and why should they do anything until they have to?

Let me start this by saying many IP firms are already working hard to improve things and deserve the credit and support from Creditors for doing so.

The focus here has to be on the onboarding process. If the Income and expenditure is not reliable then the IVA is unlikely to be sustainable.

If the consumer doesn’t understand the terms and the commitment they are making to a long term – typically 5/6 year IAV then it is unlikely to be sustainable.

There are tools available to help IPs with I&E verification which are not expensive, there are also companies that can help improve communications to make these easier for customers to understand.

Yes there is a real cost to these but there is also a very real and significant cost of early failures to IP firms.

Every step in the right direction is a positive one. It doesn’t have to involve significant cost or investment, it may simply be a change in internal processes or policy or how the IP sources its customers or an improvement in the technology.

Conclusion

Change is coming to the IVA market but regulatory and structural changes are still a long way off.

In the meantime there is a real opportunity to significantly improve the way the market operates if only individuals within each constituent element, are willing to work towards a better and more sustainable future.

Let us hope that in 2025/26 we can begin to see the ripples of change for the better in the IVA market. In 2026/27 the Insolvency service will begin to consult on the end of IVAs as a mass consumer debt solution. Perhaps it is time to evolve but in the meantime we should all consider what we can do to make things better and not wait for a legislative solution that is many years away.

Additional notes

The Insolvency Service has highlighted 45,917 DROs issued (a 41% increase from last year), following their decision to abolish the £90 administration fee.

The 2025 IVA Protocol makes it very difficult for an IVA to be recommended over a DRO where someone is eligible. This will bring affordability assessments under close scrutiny going forward.

Electronic signatures have been introduced for Bankruptcy Order documents, reducing processing time from 6 weeks to just 4 days.